Invoice Billable Time

Manager Menu-Tabs > Billable Time- Expenses

Invoicing Billable Time

Manager can directly invoice billable time.

When you first record an instance of billable time, its status will be set to Uninvoiced.

To inquire about the status of billable time you can use the Billable Time tab or the Customer tab.

Example Inquiry

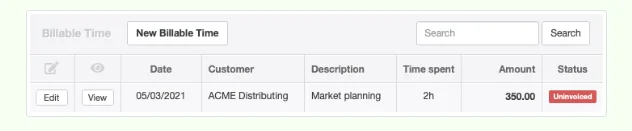

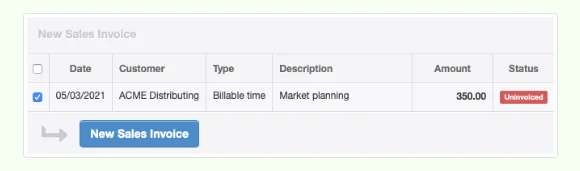

In the Billable Time tab, Sample Consulting sees the uninvoiced billable time amount of 350 for ACME Distributing:

In the Billable Time tab, Sample Consulting sees the uninvoiced billable time amount of 350 for ACME Distributing:

Invoice Billable Time

Example Invoice

To invoice billable time to a customer, go to the Customers tab and Click:

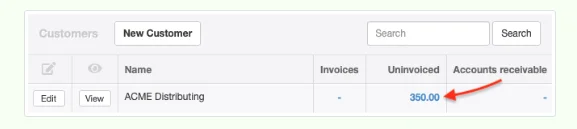

Sample searches for ACME Distributing and The Customer Summary Screen displays with information about their invoices.

Under the Uninvoiced column, click the amount for the customer you are invoicing.

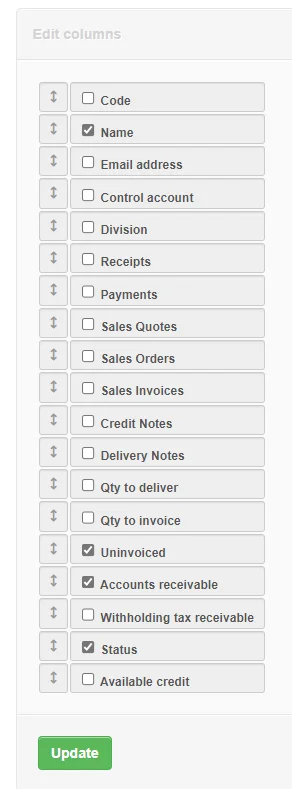

If the Uninvoiced column does not appear in the listing, at the bottom of the screen click on Edit columns.

An Edit Columns screen displays that allows you to select items that display in the customer screen.

Select the items you want to bill to the customer, then click New Sales Invoice.

Note

If you have also entered billable expenses for the customer, these will appear in the same list and can be selected for invoicing along with billable time.

If you have also entered billable expenses for the customer, these will appear in the same list and can be selected for invoicing along with billable time.

Example

Sample selects the billable time entry for 350 and clicks the button:

Sample selects the billable time entry for 350 and clicks the button:

A sales invoice will be created instantly.

Example

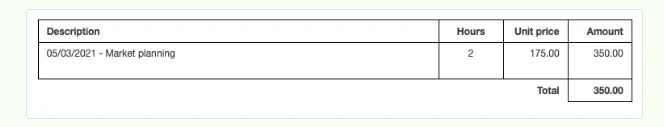

Sample’s sales invoice lists the date and description for the billable time, the hours spent, and rate (as unit price):

Sample’s sales invoice lists the date and description for the billable time, the hours spent, and rate (as unit price):

If you wish to modify the invoice, especially to add additional line items, offer discounts, or mark up the billed time for extra profit, click Edit, make any changes, and click Update. When you go back to the Billable Time tab, you will see the status of your uninvoiced items has changed to Invoiced.

Example

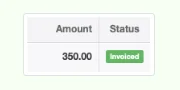

Sample verifies the status in the Billable Time tab:

Sample verifies the status in the Billable Time tab:

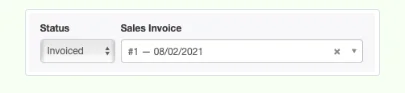

If you click the Edit button for the time entry in Billable Time, you will see the newly created sales invoice has been automatically added to the Status field.

Example

Sample clicks to see the original time entry, which shows both the change of status and the relevant sales invoice:

Sample clicks to see the original time entry, which shows both the change of status and the relevant sales invoice:

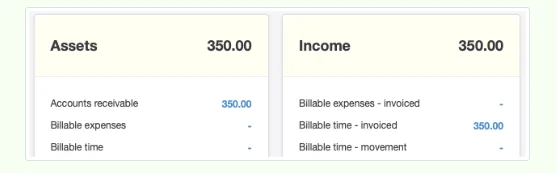

Creating a sales invoice with billable time transfers the value of the time from the Billable time asset account to the Billable time - invoiced account.

Example

Sample Consulting’s financial statements show the result of invoicing:

Sample Consulting’s financial statements show the result of invoicing:

Notes

You cannot add billable time to an existing sales invoice. Generate a sales invoice from the Customers tab first. Then add any other necessary line items.

Discounts and markups of billable time on a sales invoice from their recorded value have no effect on the Profit and Loss Statement besides changing the balance of Billable time - invoiced. Nor do they change the value of the time recorded on the billable expense transaction. This is because billable time does not represent an actual financial transaction until it is invoiced. It is only carried in Billable time - movement as imputed income. If that imputed income is modified by a discount or markup during invoicing, its value in Billable time - movement is still zeroed out by the act of invoicing. This is distinctly different from billable expenses, which have real costs, and for which discounts or markups are reflected in a difference between Billable expenses - invoiced and Billable expenses - cost.

Likewise, the value of a billable time entry in the Billable time asset account will be zeroed out when the underlying time entry is invoiced, regardless of any discount or markup. Similar to income recognition, the value of billable time in the Billable time account is only an imputed asset until it is invoiced. Then, it is transferred to Accounts receivable at the amount actually invoiced. Thus, before invoicing, the value of a billable time entry is the same in Billable time and Billable time - movement. After invoicing, its value is the same in Accounts receivable and Billable time - invoiced.