Cash or Accrual Accounting

Manager Setup > Summary > Summary Settings

Cash or Accrual Basis of Accounting

An important decision for any business is whether to adopt accrual or cash basis accounting.

In very simple terms, accrual basis accounting records income when earned and expenses when incurred, whether or not accompanying receipts and payments happen at the same time. (More technically, expenses are recorded during the period when the income they are associated with is earned.)

Cash basis accounting records income when money is received and expenses when money is paid out.

Accrual basis accounting more completely reports both financial performance and position. It is generally preferred by accountants, because it shows when revenue has been earned and debts incurred, regardless of whether money has yet changed hands. It provides more and better financial information for managing the business.

Cash basis accounting is usually employed only by very small, simple businesses, often those without inventory. It emphasizes the importance of cash in a company’s financial picture.

The choice between these options may be influenced by governmental laws and regulations. Many businesses start on the cash basis. But frequently, as revenue increases beyond some threshold or inventory is added, authorities require a change to accrual basis accounting. Manager can handle the switch easily.

Note

Me, being an accountant, recommend using the accrual basis of accounting. Manager is also easier to set up and enter beginning balances using the accrual basis if you use my simplified methods for entering beginning balances.

Choosing overall accounting basis

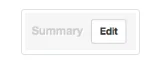

To change between accrual and cash basis accounting in Manager, click Edit at the top of the Summary page:

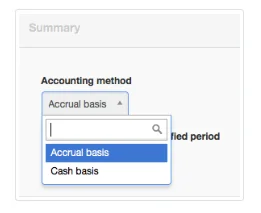

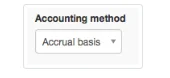

Select one of the two accounting methods in the dropdown box and click Update:

Note

Balances of many accounts may change or disappear from the Summary when cash basis accounting is selected because elements contributing to them have not been recognized through receipt or payment of funds. Manager will still make all necessary calculations, though. Account balances will be restored when accrual basis accounting is again selected. No information is lost when switching back and forth between methods.

Choosing accounting basis for reports

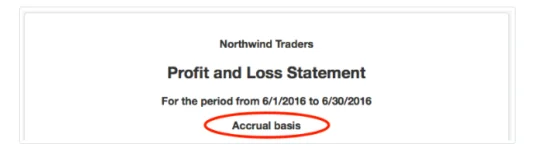

Many reports available in Manager can be created for either accounting method, regardless of which has been chosen for everyday use. When creating or editing a report, select the desired accounting method in the dropdown box:

The report will display the accounting method used in its heading:

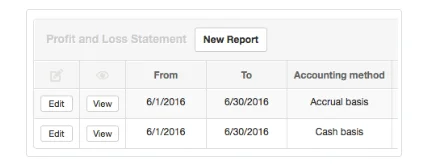

Reports of both types can be created and saved for the same period and will be available when the particular report is selected in the Reports tab:

Cash Basis

Note: If using the cash basis and wanting to keep up with inventory quantities do not enter costs or use inventory revaluation. Also, use the default periodic inventory method.