Accounts Payable

Manager Setup > Starting Balances > Accounts Receivables-Payables

Accounts Payable Modified Setup Instructions

Starting balances exist only if you are transferring an existing business to Manager from another accounting system. In that case, you may need to set starting balances for suppliers with or to whom, on the day you begin using Manager, sometimes referred to as the start date:

- You have available credit unrelated to purchase invoices, or

- You owe money because of unpaid purchase invoices.

Before you can enter any type of starting balance, your suppliers themselves must be created.

A Supplier in Manager refers to an individual, business, or organization from whom you purchase goods or services on ctedit, indicating an Accounts Payable relationship. You don't need to set up someone as a supplier for every purchase. If a purchase is paid for in cash immediately, you can process it without having to create a supplier.

Initial Balance Setup

When a supplier is created, their starting balance is zero. If migrating from another accounting system, enter unpaid invoices for this supplier under the Purchases Invoices tab. Take care when entering the invoice dates. They all should be prior to your start date.

Accrual Method Of Accounting

Enter unpaid purchase invoices

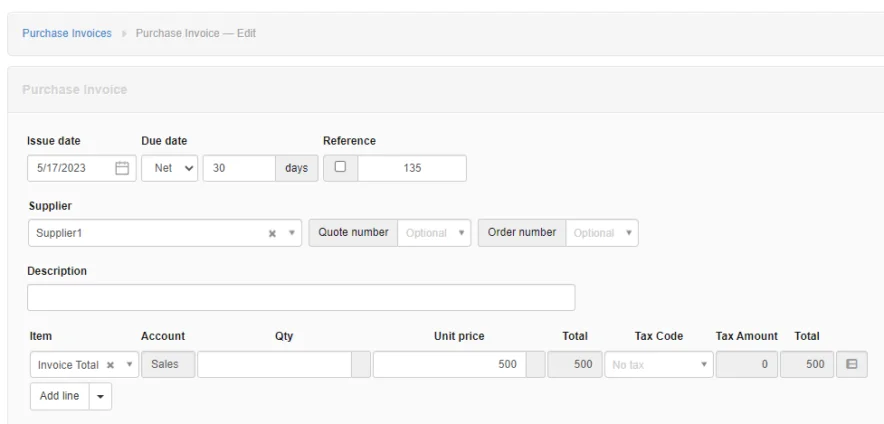

Enter a starting-balance invoice in a similar manner as a regular purchase invoice. The Issue date field will, by default, be prefilled with the current date. Edit this to match the original issue date from your old accounting system.

Manager uses these pre-start purchase invoices to establish starting balances in Accounts payable. They will not affect profit and loss statements during the current or later financial periods. If an invoice has been partially paid on the day you begin using Manager, only its remaining balance due should be entered.

Entering unpaid invoices individually ensures you can run supplier aging and other supplier reports in Manager from day one. Use a dummy non-inv item so inventory balances are not affected.

Initial Balance Setup

When a customer is created, their starting balance is zero. If migrating from another accounting system, enter unpaid invoices for this customer under the Purchase Invoices tab. Take care when entering the invoice dates. They all should be prior to your start date.

When finished, click Create to save the invoice. Repeat for all open purchase invoices preceding your start date.

If a Non-inventory item has not already been set up when entering sales invoices set it up now.

Setup Non-inventory item

If not already enabled, Enable the Settings for Non-inventory items

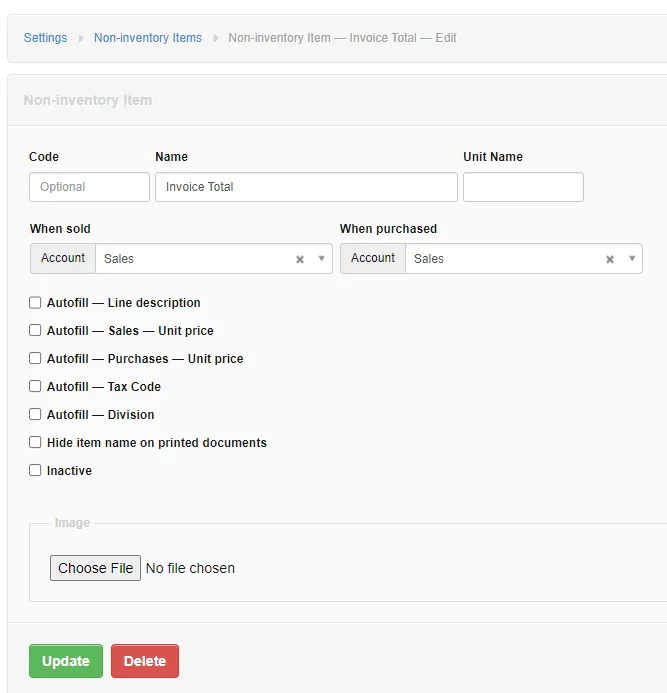

Add a Non-inventory item named Invoice Total

Click On New Non-inventory item

Enter Name - Invoice Total

Enter

When Sold

When PurchasedAccount - Sales

Account - Sales

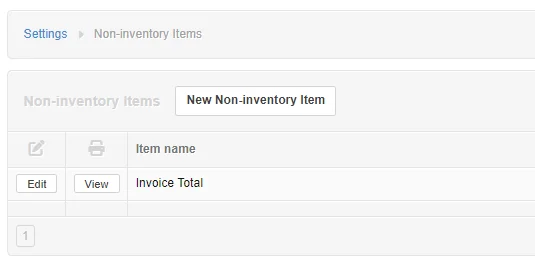

If you click on Non-inventory items a listing appears with all your non-inventory items. In our example we only have one.

Example

In our simple example, we'll be entering one starting unpaid supplier invoice assuming our start date is June 1 and our beginning unpaid invoice is dated in May.

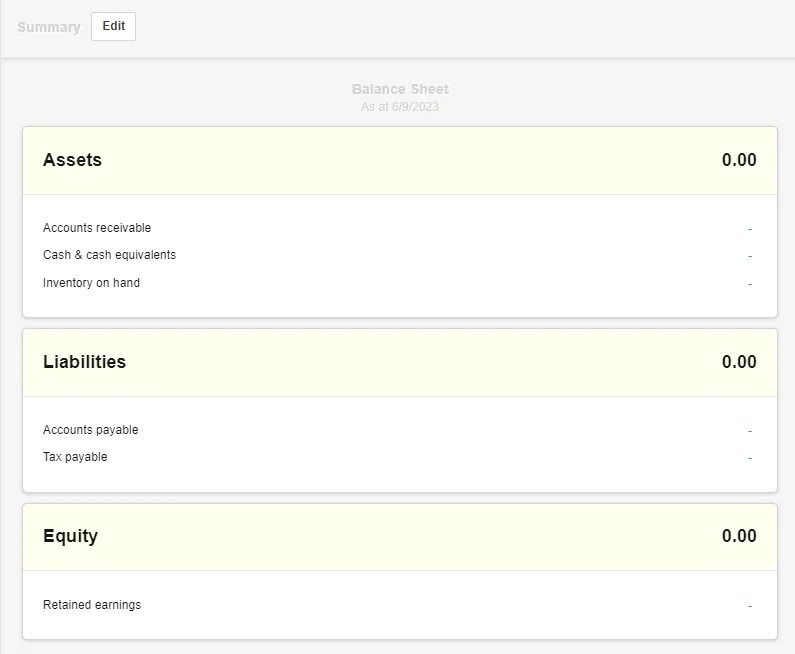

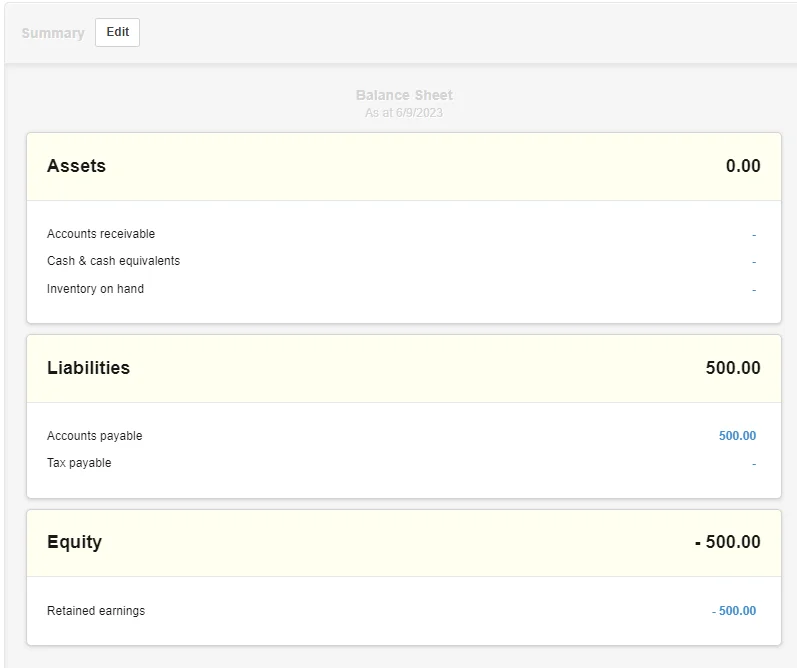

The below Summary Balance Sheet includes the Accounts Payable account with no balances entered.

Our invoice is Invoice Numbe 135 in the amount of 500 for Supplier1 dated May 17 and terms of Net 30.

Select the Purchases Invoice Tab and enter a New Invoice

- Enter Supplier1

- Enter Invoice Date of May 17

- Enter Terms of Net 30

- Select the Item and select the Non-inventory item Invoice Total

- The assigned Sales account Sales displays

- Enter the amount of 500

Select Create

The Summary Balance Sheet now displays an Accounts Payable Balance of 500.

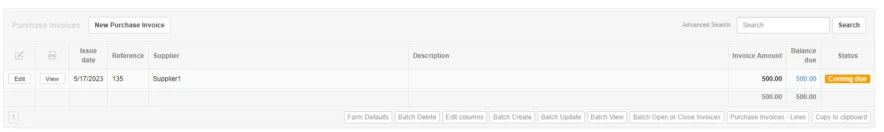

If you click on the Purchases Invoices tab, the purchases invoice listing displays the invoice entered and the total amount of 500.

Continue to do this for all your supplier unpaid invoices.

Cash Method Of Accounting

If using the Cash Basis of accounting you need to create an expense account in your Chart Of Accounts named Prior Purchases and use this account for purchases instead of the Sales account used above when using the Accrual Basis.

Click On New Non-inventory item

Enter Name - Invoice Total

Enter

When Sold

When PurchasedAccount - Sales

Enter your unpaid invoices as explained above using the accrual method of accountingAccount - Prior Purchases

Note

By using a Non-inventory item no adjustments are needed when entering the inventory quantities or costs.