- Demonstrate petty cash journal entries and reconciliation

Back to our example in the previous section: Greta, the Chief Financial Officer (CFO) of a business, establishes a petty cash fund by writing a check for $100, cashing it at the bank in exchange for five $20s, and putting the cash in a secure box at the front desk. The CFO puts her assistant, Frank, in charge of the funds. The bookkeeper, Carlos, records this transaction in the journal as follows:

| Date | Description | Post. Ref. | Debit | Credit |

|---|---|---|---|---|

| 20– | ||||

| Jan. 1 | Petty Cash | 100.00 | ||

| Jan. 1 | Checking Account | 100.00 | ||

| Jan. 1 | To record transfer of cash from checking to cash box |

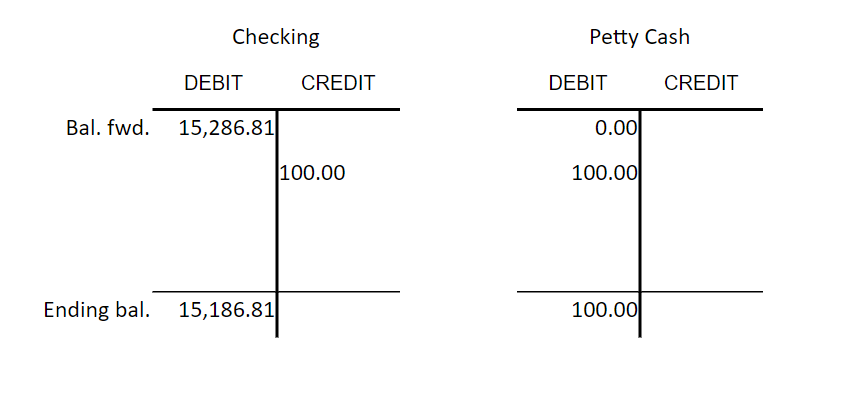

After posting to the ledger (we’ll use T accounts here), the checking account balance will go down by $100 and the petty cash balance will go up by $100. Both of these numbers reflect reality and you could verify them by (a) reconciling the bank statement to the checking account in the general ledger and (b) by looking in the cash box and counting the money in there.

At the end of the month, assume the $100 petty cash fund has a balance of $6.25 in actual cash (a five-dollar bill, a one-dollar bill, and a quarter). Frank, who is the responsible person, has been filling out the voucher during the month, and all the receipts are stapled to the voucher.

| Petty Cash Voucher | ||||

| Custodian: Frank Wright | Balance: | 100.00 | ||

| DATE | Paid to/Rec’d from | Purpose | Amount | Balance |

|---|---|---|---|---|

| 1/10/20XX | UPS | shipping to customer | 22.75 | 22.75 |

| 1/10/20XX | USPS | postage stamps | 50.80 | 73.55 |

| 1/15/20XX | Carmen S. Diego | flowers for office | 19.05 | 92.60 |

- An independent employee, say the controller (Fei Xu), examines and approves the petty cash voucher;

- Fei Xu sends it to the accounts payable clerk (Keisha) who cuts a check for $93.75 payable to Petty Cash;

- The company treasurer, or CFO in this case, Greta, signs the check (along with a bunch of other checks) and it goes back to Frank, the petty cash custodian; and

- Frank takes the check to the bank, cashes it, and then restores the cash in the fund to its $100 balance.

The journal entry created when the check is cut looks like this:

| Date | Description | Post. Ref. | Debit | Credit |

|---|---|---|---|---|

| 20– | ||||

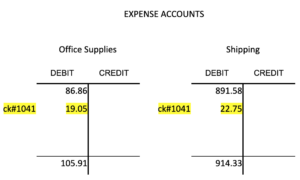

| Feb. 1 | Shipping Expense | 22.75 | ||

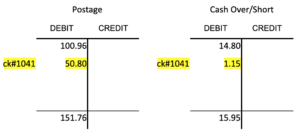

| Feb. 1 | Postage | 50.80 | ||

| Feb. 1 | Office Supplies | 19.05 | ||

| Feb. 1 | Cash Over/Short | 1.15 | ||

| Feb. 1 | Checking Account | 93.75 | ||

| Feb. 1 | To record check #1041 replenishing petty cash |

Sometimes the petty cash custodian makes errors in making change from the fund or doesn’t receive correct amounts back from users. These errors cause the cash in the fund to be more or less than the amount of the fund less the total vouchers. We post the discrepancy to an account called Cash Over and Short. The Cash Over and Short account can be either an expense (short) or a revenue (over), depending on whether it has a debit or credit balance. It’s uncommon to have cash over, but it happens occasionally.

Right after this entry has been recorded, the check cashed, and the proceeds put in the box, there will be $100 in the box again, an amount which will match the general ledger account. In fact, there is always $100 in the box if you add up all the receipts and the cash (more or less, depending on the cash over/short situation). This system simply delays the recording of small expenses until the end of the accounting cycle or the fund is replenished. It’s not really an adjusting journal entry because there is an actual transaction being recorded. Having a petty cash account is just more convenient than going to the accounts payable clerk every time someone needs a stamp or a liter of coffee for a meeting.

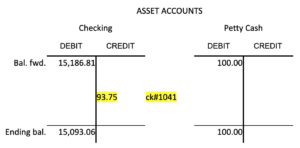

Using T Accounts to stand in for full ledgers would make posting the entry look like this:

Entries to the petty cash fund itself are fairly rare. With your knowledge of accounts, debits and credits, and T accounts, you should be able to figure out any entries that crop up. Other than the entry establishing the fund, there are only three other times you might make an entry to the petty cash account:

- If the fund needs more cash, the journal entry looks the same as the entry to establish the fund.

- If some cash is returned to the bank because the accounting staff (probably the controller or the CFO) think there is too much in the box, the entry is the reverse of the establishing entry.

- If petty cash is closed out because it’s no longer needed, the entry is the reverse of the establishing entry.

As you think back on this system, note that there are several internal controls in place, most notably segregation of duties, assignment of responsibility, and a reconciliation (monitoring) process. In the next section, we’ll look at one of the most important cash controls, the bank reconciliation process, in detail.