- Compute and journalize bad debt expense as a percentage of receivables (balance sheet method)

The percentage-of-receivables method estimates uncollectible accounts by determining the estimated net realizable value of accounts receivable, so many accountants refer to this as the balance-sheet method.

There are two ways to do this method: a simple way that, of course, is not the best practice and a more complicated but more reliable way that uses an aging analysis that we’ll cover in the next section.

Here is Larkin Co.’s subsidiary ledger from year one before any adjustment for bad debt:

| Customer | Amount Owed |

|---|---|

| A | 57,500 |

| B | 22,000 |

| C | 74,500 |

| D | 8,000 |

| E | 12,500 |

| F | 25,000 |

| G | 50,500Single line |

| 250,000Double line | |

If Larkin estimates 3% of ending accounts receivable will be uncollectible, or conversely, estimates 97% of accounts receivable are collectible, then the allowance for doubtful accounts should be $7,500, calculated as follows:

Accounts Receivable, gross × estimated uncollectible = allowance

Or

Accounts Receivable, gross × estimated collectible = net realizable value

| Accounts Receivable, gross | $250,000 |

|---|---|

| X % uncollectible | 3.0% |

| Allowance | $7,500 |

| Accounts Receivable, gross | $250,000 |

|---|---|

| X % collectible | 97.0% |

| Net realizable value | $242,500 |

| Accounts Receivable, gross | $250,000 |

|---|---|

| Allowance | (7,500) |

| Net realizable value | $242,500 |

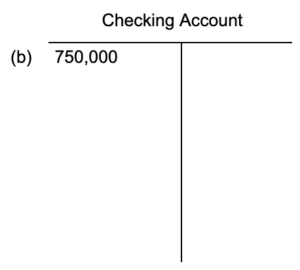

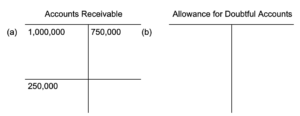

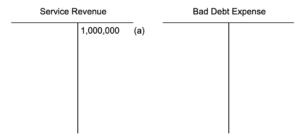

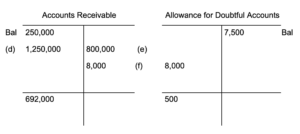

Let’s look at Larkin Co. again. Remember they billed out $1 million in services during the year (a) and collected $750 thousand of that (b):

Now we have to book the allowance for doubtful accounts. Note: we did not calculate bad debt expense. We calculated the uncollectible accounts based on the accounts receivable we had outstanding at the end of the year.

| Date | Description | Post. Ref. | Debit | Credit |

|---|---|---|---|---|

| 20– | ||||

| Dec 31 | Bad Debt Expense | 7,500.00 | ||

| Dec 31 | Allowance for Doubtful Accounts | 7,500.00 | ||

| Dec 31 | To record bad debts as a percentage of accounts receivable |

Notice, other than the amount and description, this is the same entry we made under the percentage of sales method.

However, there is a significant difference (other than the amount).

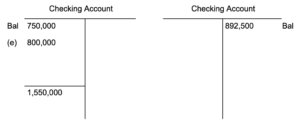

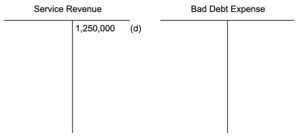

Let’s look at year two. Sales of $1,250,000 (d) and collections of $800,000 (e) and the write off of $8,000 (f).

Now it’s time to calculate the allowance for doubtful accounts:

| Accounts Receivable, gross | $692,000 |

|---|---|

| % uncollectible | 3.0% |

| Allowance | $20,760 |

| Accounts Receivable, gross | $692,000 |

|---|---|

| % collectible | 97.0% |

| Net realizable value | $671,240 |

| Accounts Receivable, gross | $692,000 |

|---|---|

| Allowance | (20,760) |

| Net realizable value | $671,240 |

(Quick: Get out your calculator and check the math.)

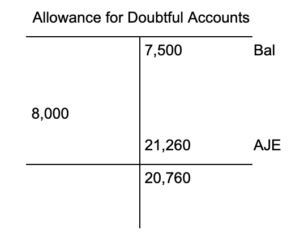

The allowance for doubtful accounts, based on the percentage of sales, should be a credit balance of $20,760. Right now, it has a debit balance of $500 because last year we booked $7,500 but the actual write off was $8,000. Go back and look at the T account for the allowance.

What entry would you have to make to the allowance account to get the balance to be $20,760?

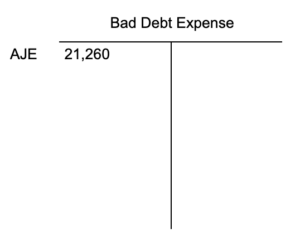

Notice that bad debt expense in this case is simply the other half of the entry to get the balance sheet account adjusted. The focus in this case is on the net realizable value of the receivables, and the income statement (bad debt expense) is relegated to second place.

| Date | Description | Post. Ref. | Debit | Credit |

|---|---|---|---|---|

| 20– | ||||

| Dec 31 | Bad Debt Expense | 21,260.00 | ||

| Dec 31 | Allowance for Doubtful Accounts | 21,260.00 | ||

| Dec 31 | To record bad debts as a percentage of receivables |

This whole process is worth a review if you don’t have a clear understanding of it yet. Walk through it step-by-step:

- Calculate the balance you need to have in the account (allowance for doubtful accounts).

- Examine the current account balance.

- Determine what entry, debit or credit, and amount you need to have in order to get the balance where it needs to be.

- Test your hypothesis using T accounts.

- Write the entry, post it, and make sure it did what you wanted it to do.

This process works for all kinds of transaction analysis. For instance, let’s say you wrote off an account earlier in the year, but then the company paid unexpectedly. This doesn’t happen very often, but it’s possible.

| Date | Description | Post. Ref. | Debit | Credit |

|---|---|---|---|---|

| 20– | ||||

| Dec 31 | Allowance for Doubtful Accounts | 2,000.00 | ||

| Dec 31 | Accounts Receivable | 2,000.00 | ||

| Dec 31 | To write off bad account |

And then, surprise, the company pays you $1,500 a few months later. You know you have to debit cash, but to what account do you post the credit?

You could just post the credit to allowance for doubtful accounts, but the proper way to handle this is to re-establish the receivable by reversing the write-off (partially) and then recording the payment against the account.

| Date | Description | Post. Ref. | Debit | Credit |

|---|---|---|---|---|

| 20– | ||||

| Mar 17 | Accounts Receivable | 1,500.00 | ||

| Mar 17 | Allowance for Doubtful Accounts | 1,500.00 | ||

| Mar 17 | To reverse prior write-off (partial) |

| Date | Description | Post. Ref. | Debit | Credit |

|---|---|---|---|---|

| 20– | ||||

| Mar 17 | Checking Account | 1,500.00 | ||

| Mar 17 | Accounts Receivable | 1,500.00 | ||

| Mar 17 | To record payment on account |

Hopefully, your accounting software has a process in place to accomplish this transaction, but it’s rare enough that you may have to figure out the result you want and then make it happen using the built-in systems.

Next, we’ll look at a more sophisticated way to calculate the net realizable value of accounts receivable and the allowance for doubtful accounts, but first check your understanding of the percentage of receivables method.