Payroll Records

Payroll Records

Payroll Records

One area of your business, even if you're a small business, where you must maintain good records is Payroll. You need to dot your i's and cross your t's in order to comply with all the government laws and regulations and also to protect your business from employee lawsuits. Some people still want something for nothing. This lesson provides samples of common payroll forms and records used for maintaining your payroll and employee information.

In prior lessons, we discussed some of the forms, documents, government reports, and records needed in order to run and maintain an adequate payroll system. A Payroll System is nothing more than the forms, documents, records, software, and procedures and controls used for monitoring employees, recording employee time, calculating and processing employee checks, and complying with all governmental requirements. The system can include manual as well as computerized operations.

Enough of my ranting, let's take a look at some of the forms and records that make up a Payroll System. The purpose of this lesson is not to provide you with detailed instructions for filling out each line of all the various payroll forms. The actual purpose is to make you aware of the various payroll forms and records that a small business owner at least needs to be familiar with.

Employment Application

The whole payroll process starts with your employment application. You should thoroughly check out your employees and any references supplied. In addition, you may want to even hire a service to do a background check (some types of business are required to do a background check).

The whole payroll process starts with your employment application. You should thoroughly check out your employees and any references supplied. In addition, you may want to even hire a service to do a background check (some types of business are required to do a background check).

Form W-4

Have all employees fill out IRS Form W-4, Withholding Allowance Certificate. This form provides the information necessary for properly withholding the correct amount of income tax from your employee's wages. The form has been redesigned. Employers and Employees can still use their old forms although the IRS encourages adopting the new form. The new form is required when starting a new job.

Form I-9

Fill out Form I-9, Employment Eligibility Verification for each employee hired. This form is required and used to verify that every employee you hire is eligible to work in the United States.

Payroll Source Documents

Time Sheets

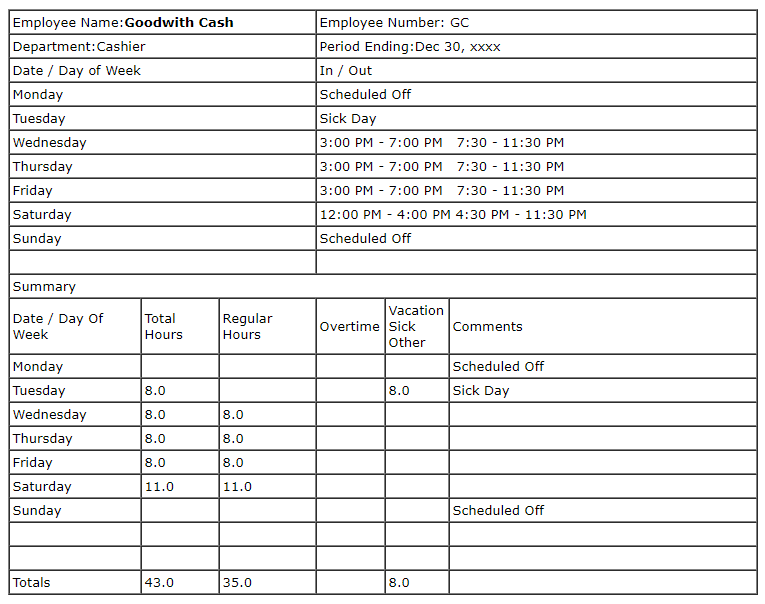

One type of document that a business can use to record and track their employee's time is called a time sheet. The sheet includes the date worked, regular hours worked, overtime hours worked, holiday, sick, or personal hours and any other information you need to properly record and calculate your employee's wages.

Time Card

Another basic document for recording the amount of time an employee works. The time card is used in conjunction with a time clock where the employee enters his/her card to clock in and out and the day and hour are recorded on the card. With the computer age, new innovations such as employee ID cards similar to a credit card are used to track an employee's work time.

We'll use our cashier, Goodwith Cash, from a prior lesson as an example for our timecard.

Other Payroll Source Documents

- Weekly Tip Reports for all tipped employees.

- Production / Piece Rate Report for production / piece rate employees.

- Bonus Report & Calculation for employees entitled to a bonus.

- Commission Report & Calculations for employees paid based on a commission.

Our Payroll General Ledger Accounts

In order for the section on the Payroll Special Journal to make any sense, you may need some basic knowledge regarding Journals, the General Ledger and its associated Chart of Accounts, and of course debits and credits. If you need to review these topics, they're covered in my free So, you want to learn Bookkeeping! Introductory Tutorial.

We're going to use Ma's Secret Recipe business from a prior lesson to illustrate recording our entries in our payroll accounting records. Ma's a smart gal so she decided she wanted to keep track of her payroll costs by the type of employees that she needs to help her run her business.

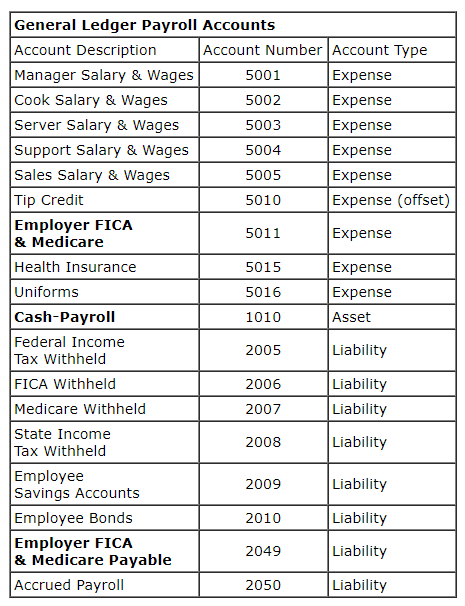

A complete chart of accounts has all our asset, liability, revenue, expense, and equity accounts. In this lesson, we'll only be concerned with our payroll expense and liability general ledger accounts.

How do you determine what payroll accounts to set up ? Basically, that decision is up to each owner and depends on how much information you want to have available for analyzing and reviewing your payroll costs. Ma could have used just one account called Payroll Expense where the salaries and wages of all her employees are charged, but by doing this she doesn't have much information available (without doing a special study) for quickly analyzing where she's spending her payroll dollars.

Ma has the following General Ledger Payroll accounts:

Why are some of the accounts in bold letters ?

The Cash-Payroll account is in bold just to emphasize the fact that although not necessary, Ma set up a bank account just to use for issuing all her payroll checks called Cash-Payroll. She could have used her regular checking account if she had wanted to. Ma did this so that all the checks issued for payroll would be drawn on this bank account and this would save her sorting thru her regular bank account to find payroll checks if she needed them.

How does this work ? Ma determines what her net payroll is and then writes a check or transfers funds from her Cash-Regular bank account to her Cash-Payroll bank account. We'll make a general journal entry to illustrate how this transaction is recorded.

What do you think the balance of this checking account should normally be ? Zero !!!! The reason is that the amount we transfer into this checking account is always equal to the total of all the payroll checks that have been written.

The Employer FICA Expense and Liability Accounts are in bold to emphasize the fact that as I explained in an earlier lesson, Payroll Taxes and Withholdings, employers are required to match and contribute the amounts deducted from their employees wages for social security and medicare.

These accounts are the accounts Ma set up to record these expenses and liabilities.

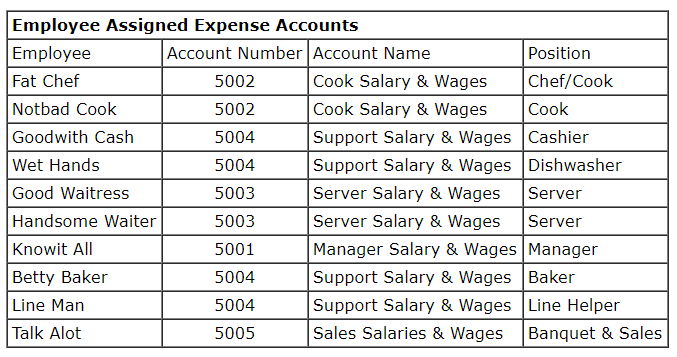

In addition to having our Payroll General Ledger Accounts (Payroll Related Chart of Accounts), we also need to assign all of our employees to a payroll expense account. Ma prepared the following Table that shows what account her employees are assigned and charged to.

Note: In our example we only assigned one payroll expense account to each of our employees. You may; however, allocate (charged) an employee's salaries and wages to more than one payroll expense account if as an example they split their time working in two departments.

As I stated earlier, Ma's pretty slick, but can you think of any additional useful payroll information that Ma might in the future want to think about setting up additional General Ledger Accounts for ? Remember there your books and records and you can make them as useful as you want.

OK - I'll help ! How about ?

- Overtime Accounts to track how much Ma's spending on overtime.

- Vacation, Holidays, and Sick Pay Accounts to track how much her employee's are costing her for time off.

Payroll Journal (Register)

In my So, you want to learn Bookkeeping! Special Journals Tutorial we discussed the most common types of journals used for recording and summarizing your business transactions; however, the Payroll Special Journal was just mentioned but not illustrated or discussed. There actually was a madness to my reasoning. Since a whole tutorial (this one) is devoted to Payroll this is where the discussion actually belongs.

For those of you, that didn't take this course (and even those that did), let's review a few points from my Special Journals Tutorial.

A Journal is an accounting record that is used to record the different types of transactions using various source documents. Source Documents are the original sources of information that provide documentation (proof) that a transaction has occurred such as sales invoices (tickets), invoices from suppliers, contracts, checks written and checks received , promissory notes, and various other types of business documents. These documents provide us with the information needed to record our financial transactions in our bookkeeping records. If you recall a transaction is any event or condition that must be recorded in the books of a business because of its effect on the financial condition of the business, such as buying and selling. A business deal or agreement.

Journals are often called or referred to as the books of original entry. The reason is that this is the first place that business transactions are formally recorded. Specialized Journals are journals used to initially record special types of transactions such as payroll, sales, cash disbursements, and cash receipts in their own journal.

You can think of a Journal as a Financial Diary.

Why Use Special Journals ?

- Groups and records transactions of a like nature. A familiar example is recording all cash received by a business in one place.

- Saves time with summary and less frequent postings to the General Ledger.

- Allows a business to have different individuals responsible for different journals thereby increasing internal controls and allocating the record keeping workload.

A Payroll Journal (Register) is normally used as the record (special journal) that summarizes the payroll information by pay period and is used to post the summary totals to the General Ledger. Small businesses could use their Cash Disbursement Journal but I recommend you use a special journal for recording your payroll transactions. This provides you with all the information about payroll in one convenient place (your payroll journal).

The Payroll Journal records the expense accounts where salary and wage gross amounts are charged. In addition, all the deductions taken from salary and wages are charged to the appropriate liability or expense offset account.

Let's refer back to Ma and our payroll calculations in an earlier lesson. We performed all the necessary calculations for issuing our employees their checks -now we need prepare the checks and record them.

Note:Rather than preparing individual payroll checks, many businesses offer what is called Direct Deposit where an employee's net earnings are deposited directly into their personal bank account.

Our first step is to refer to our General Ledger Chart Of Accounts and determine what accounts we need to use to record our payroll entries in our journal. Next, we need to summarize and post our payroll transactions in the proper accounting/bookkeeping records.

Following these steps, Ma prepared the following Payroll Journal for her pay period paid Dec 30, xxxx.

| Payroll Journal (Register) Week Ending December 30, xxxx | |||||||||||

| Employee | Payroll Debits Account Amount | Social Security Credit 2006 | Medicare Credit 2007 | Inc Tax With Credit 2005 | State Tax Credit 2008 | Medical Ins Credit 5015 | Savings Bonds Credit 2009 | Tip Credit 5010 | Uniform Credit 5016 | Cash Payroll Credit 1010 | Ck No |

| Fat Chef | 5002 1567.32 | 90.97 | 21.28 | 34 | 157 | 100 | 25 | 25 | 1114.07 | 1000 | |

| Notbad Cook | 5002 1111.15 | 62.69 | 14.66 | 111 | 100 | 20 | 802.80 | 1001 | |||

| Goodwith Cash | 5004 344.00 | 18.22 | 4.26 | 6 | 34 | 50 | 231.52 | 1002 | |||

| Wet Hands | 5004 311.76 | 16.23 | 3.80 | 2 | 32 | 50 | 207.73 | 1003 | |||

| Good Waitress | 5003 630.00 | 35.96 | 8.41 | 37 | 63 | 50 | 250 | 185.63 | 1004 | ||

| Handsome Waiter | 5003 398.80 | 21.63 | 5.06 | 16 | 40 | 50 | 50 | 216.11 | 1005 | ||

| Know Itall | 5001 3,500.00 | 203.55 | 47.60 | 87 | 350 | 217 | 2594.85 | 1006 | |||

| Betty Baker | 5004 344.40 | 18.25 | 4.27 | 34 | 50 | 237.88 | 1007 | ||||

| Line Man | 5004 300.00 | 15.50 | 3.63 | 30 | 50 | 200.87 | 1008 | ||||

| Talk Alot | 5005 290.00 | 14.88 | 3.48 | 29 | 50 | 192.64 | 1009 | ||||

| Period Totals | |||||||||||

| Debits | Credits | ||||||||||

| Account Amount | 5001 3500.00 | ||||||||||

Account Amount | 5002 2678.47 | ||||||||||

Account Amount | 5003 1028.80 | ||||||||||

Account Amount | 5004 956.16 | ||||||||||

Account Amount | 5005 290.00 | ||||||||||

| Totals | 8797.43 | 497.88 | 116.45 | 182 | 880 | 767 | 45 | 300 | 25 | 6009.10 | |

| x | x | x | x | x | x | x | x | x | x | x | |

| Employer Share Fica & Medicare | |||||||||||

Debit | 5011 | 614.33 | x | ||||||||

Credit | 2049 | 614.33 | x | ||||||||

The journal contains a column for the employee's name, account number, payroll expense accounts and a column for each of the various types of payroll deductions. We could have set up a column for all the payroll expense accounts if we had wanted to. Ideally, you should set up a column for each of your general ledger payroll accounts.

Why the yellow highlighted (X) 's ? To emphasize that these totals have been posted from the Payroll Journal to the appropriate General Ledger Accounts. Actual postings to the General Ledger Accounts are not illustrated. This topic was covered in depth in My, so you want to learn Bookkeeping! - Special Journals tutorial.

What about the (X) in the check number column ? This is used to denote that the check and all its information has also been recorded in the Employee's Earnings Record.

Why the bold debit and credit in the journal ? Once again, I wanted to emphasize the fact that a business that has employees is responsible for matching the deductions taken from employee wages and salaries for social security and medicare. The (X) 's denote that this entry for employer taxes has been posted to the General Ledger.

Just for fun, let's see if the total of our debits equal the total of our credits. I know, adding up columns of figures is not really my idea of fun either.

| Debit Amounts | Credit Amounts | ||||

| Account | Account Name | Amount | Account | Account Name | Amount |

| 5001 | Manager Salary & Wages | 3500.00 | 2005 | Federal Income Tax | 182.00 |

| 5002 | Cook Salary & Wages | 2678.47 | 2006 | FICA Withheld | 497.88 |

| 5003 | Server Salary & Wages | 1028.80 | 2007 | Medicare Withheld | 116.45 |

| 5004 | Support Salary & Wages | 1300.16 | 2008 | State Income Tax Withheld | 880.00 |

| 5005 | Sales Salary & Wages | 290.00 | 5015 | Health Insurance | 767.00 |

| 2009 | Employee Saving Accounts | 45.00 | |||

| 2010 | Employee Bonds | 25.00 | |||

| 5010 | Tip Credit | 300.00 | |||

| 5016 | Uniforms | 25.00 | |||

| 1010 | Cash Payroll | 2788.33 | |||

| Total Debits | 8797.43 | Total Credits | 8797.43 | ||

Sure enough, our debits equal our credits ! Don't tell me, I already know. I left out the special entry recording the employer's share of social security and medicare in my above table. I did this because I wanted to first verify that my actual payroll check entries were recorded and balanced correctly.

The Employer's Share of Payroll Taxes in the amount of $614.33 was debited to Account 5011 - Employer FICA & Medicare and the same amount was credited to Account 2049 - Employer FICA & Medicare Payable.

How did we arrive at the total of $614.33 ?

Simple- we added the amounts deducted from all employees for social security and the total amount deducted from all employees for medicare.

Social Security Deducted from Employees 497.88Medicare Deducted from Employees 116.45

Total Employer Payroll Taxes 614.33

Payroll Distribution

| Payroll Distribution Report | ||||

| Account Number | Account Name | Employee | Employee Amount | Account Amount |

5001 | Manager Salary & Wages | Knowit All | 3500.00 | 3500.00 |

| 5002 | Cook Salary & Wages | Fat Chef Not Bad Cook | 1567.32 1111.15 | 2678.47 |

| 5003 | Server Salary & Wages | Good Waitress Handsome Waiter | 630.00 398.80 | 1028.80 |

| 5004 | Support Salary & Wages | Goodwith Cash Wet Hands Betty Baker Line Man | 344.00 311.76 344.40 300.00 | 1300.16 |

| 5005 | Sales Salary & Wages | Talk Alot | 290.00 | 290.00 |

What we just did is referred to as Distributing the Payroll or Payroll Distribution. No I don't mean handing out the checks. Fortunately, Mom only has ten employees. Distributing (assigning wages to the General Ledger Payroll Accounts) can become a time consuming task if a business has a lot of employees.

What tool might make this task easier ? Good Payroll Software. Not only will good software distribute the wages, but also perform all the payroll calculations, print checks, and provide you with the reports and information needed for governmental agencies.

If you were wondering where the amounts came, they came from our Payroll Journal presented earlier.

Excel Spreadsheet Payroll Register

I've included a Sample of an Excel Spreadsheet Below. Is an Excel Spreadsheet actually the best option for calculating your Payroll ? No, but for small payrolls it can do the job.

Employee Earnings Records

In addition to our Payroll Journal, a detailed earnings record or subsidiary ledger is maintained for each employee. For illustration purposes, we'll use partial payroll data for our employee Goodwith Cash. The earnings record contains general information about the employee such as their name, address, social security number,pay period, rate of pay, and job position.

The information highlighted in yellow is the general information section of the earnings record.

The other section (non highlighted) of the record is used to record all the payroll checks issued to an employee and what earnings and deductions were used in calculating the net amount of the check.

The record is summarized by Quarter and for the Entire Year. Why summarize by Quarter ? Remember those quarterly tax reports we discussed earlier ? These records provide the needed information.

Why summarize for the Year ? We need this information in order to prepare our employee's W-2's.

The earnings record is also used as an aid in calculating any tax where a maximum earnings limit is used in the payroll calculation such as medicare and federal and state unemployment.

Employee's Earnings Record | |||||||

Employee | Social Security Number | Pay Period | Pay Type | Rate/ Amount | Position/ Job | Marital Status/ Dependents | Address |

Goodwith Cash | 999-99-9999 | Weekly | Hourly | $8.00/Hour | Cashier | 999 Some St Somecity,Somestate 99999 | |

Date | Gross Earnings | Social Security | Medicare | Income Tax | State Tax | Medical Insurance | YTD Earnings |

Quarter 1 | |||||||

Actual Weekly Payroll Checks (Not Shown) | |||||||

Totals Quarter 1 | |||||||

4250.00 | 263.50 | 61.63 | 78.00 | 425.00 | 650.00 | 4250.00 | |

Quarter 2 | |||||||

Actual Weekly Payroll Checks (Not Shown) | |||||||

Total Quarter 2 | |||||||

4600.00 | 285.20 | 66.70 | 88.00 | 460.00 | 650.00 | 8850.00 | |

Quarter 3 | |||||||

Actual Weekly Payroll Checks (Not Shown) | |||||||

Total Quarter 3 | |||||||

4750.00 | 294.50 | 68.88 | 95.00 | 475.00 | 650.00 | 13,500.00 | |

Quarter 4 | |||||||

Actual Weekly Payroll Checks (Not Shown) | |||||||

| Prior Periods | 4450.00 | 275.90 | 64.52 | 85.00 | 445.00 | 600.00 | |

Dec 30,xxxx | 344.00 | 18.22 | 4.26 | 6.00 | 34.00 | 50.00 | |

Total Quarter 4 | |||||||

4794.00 | 294.12 | 68.78 | 91.00 | 479.00 | 650.00 | 18,294.00 | |

| Year To Date | |||||||

18294.00 | 1137.32 | 265.99 | 352.00 | 1839.00 | 2600.00 | 18294.00 | |

We could have included additional columns with additional information in our employee's earning record. In all my tutorials I try to stress the fact that your records are yours and you can tailor them to suit your own needs.

Ideally your earnings records should have a column for each type of deduction that you normally deduct from your employee's wages.

Other Useful Information that we could have included:

- Actual Hours - Straight Time and Overtime

- Straight Time Earnings & Overtime Earnings

- Tips Reported for tipped employees

- Bonuses

- Sick Pay

- Holiday Pay

- Vacation Pay

- Bonds

- Savings

- Uniforms

Why would you add a column for vacation pay ? By doing this, you can easily determine how much you paid an employee for vacation days not worked. What would you have to do if you didn't have a column for vacation pay and wanted to know how much you paid an employee for vacation time ? Probably spend a lot of time searching thru and analyzing time cards or time sheets.

Summary Earnings Record

In addition to maintaining an earnings record for each employee, you should also have a summary earnings record that summarizes the total amounts of all your earnings record columns for all your employees.

In addition to maintaining an earnings record for each employee, you should also have a summary earnings record that summarizes the total amounts of all your earnings record columns for all your employees.

W-2's and W-3 Forms

Of course, at the beginning of each new year, W-2's must be prepared and given to all your employees that worked for you at any time during the prior year. Do you recall where we get the information for completing the W-2's ? The Employee Earning Records right ? Form W-3 is used to summarize all the amounts on all the employee's W-2 Forms. Most of you are probably already somewhat familiar with the W-2 form.

Payroll Files

What do you do with all these payroll forms, documents, and records ? You do my least liked business task, filing. We may not like it, but it's a necessary evil. You should maintain an Employee File for each of your employees and keep it updated with copies of any forms and documents applicable to the employee.

In addition, you should also maintain a Company Payroll File that includes a copy of any payroll forms, documents, and records required by governmental laws, rules, and regulations. This file may also include any general company payroll policies and procedures.

Employee File

What are some of these employee documents ?

- Employment Application

- Employee Performance and Pay Raise Reviews

- Employment Contracts and Agreements relating to pay rates and work hours

- Authorizations for deductions taken from wages that the employee approves

- Employee's W-4 Withholding Allowance Form

- Employee's I-9 Employment Eligibility Form

- Attendance Records

- Job Description

- Accident and Injury Reports

- Lay Off Slips (If applicable)

- Reprimands

- Awards and Special Achievements

- Time Cards & Sheets

- Tip Reports (If applicable)

- Commission Reports

- Earnings Record

- Bonus Calculations

- Garnishments

- Employee Contracts

Company File

What are some of these company payroll documents ? We discussed most of the government required forms in prior lessons.

- Form 941 Quarterly Payroll Tax Reports

- State Unemployment Reports

- Form 940 Federal Unemployment Tax Reports

- Workmen's Compensation Documents

- Copy of Company Employee Manual (If you have one)

- Job Descriptions

- Fringe Benefits Documents

- Union Agreements (If applicable)

What's Next ?

Payroll Records Video